In this update, we will review the latest developments in the Voluntary Carbon Market (VCM). This includes market trends, changes in regulatory frameworks, best practices, and carbon price developments. Stay tuned to be up to date with the current state of the carbon market.

Short roundup: market trends & key developments

In recent months, the VCM and its stakeholders – project developers, local communities, sellers, and buyers – have been challenged to further safeguard carbon credit quality, integrity and transparency. The need has been highlighted for carbon credits to deliver on their promise of either avoiding or removing carbon from the atmosphere.

Projects focusing on ‘Reducing emissions from deforestation and forest degradation’ (REDD+) have particularly been under scrutiny. Many agree that REDD+ projects are one of the most efficient mechanisms for financing forest communities and preserving biodiversity while locking away irrecoverable carbon. To ensure continued funding and support, the VCM architecture incorporates baseline updates and technological advancements to maintain quality requirements in line with best practices. Verra, the main issuer of REDD+ credits, released a new draft methodology for REDD+ projects on 19 April 2023, calling it the ‘’most significant revision" of its practices, as it looks to restore the integrity and quality of its forest carbon credits.

To add to that, market bodies like the Integrity Council for the Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Markets Integrity Initiative (VCMI) have made impactful announcements that will influence the quality of supply and effective use of carbon credits. One of these announcements is the collaboration between both bodies on 20 June 2023.

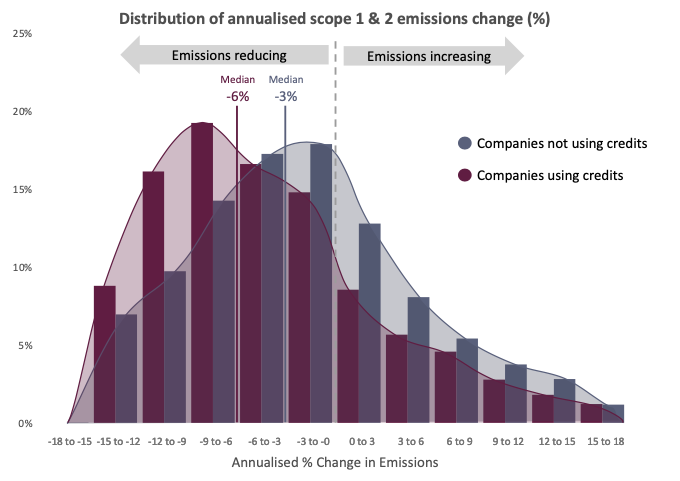

While continuously improving on current methodologies is important, it is equally important to also shed a light on the role that credits already play. Trove Research has shared a detailed report analysis of over 4,000 global companies and the link between emissions performance and the use of carbon credits. The conclusion was that companies that use material quantities of carbon credits are decarbonising at twice the rate of companies that do not use carbon credits.

REDD+: to credit or not to credit

REDD+ projects focus on conserving and restoring forests that act as vital carbon sinks, absorbing and storing significant amounts of carbon dioxide. Forests play a crucial role in mitigating climate change by removing CO2 from the air and storing it in their biomass and soil. REDD+ initiatives address deforestation and degradation, preserving valuable ecosystems and reducing carbon emissions while offering financial incentives for forest conservation, benefiting local communities and indigenous people.

These projects not only contribute to climate goals set in the Paris Agreement but also promote biodiversity conservation, protect watersheds, and enhance resilience to climate change impacts. They foster environmental protection, support local livelihoods, and offer social and economic benefits to forest-dependent communities. Overall, REDD+ projects are instrumental in the global fight against climate change, preserving natural carbon sinks and contributing to a sustainable future for our planet.For an example of how projects can support the goals of the Paris Agreement, visit our project page. Explore the sustainable development goals they endorse and discover their impact beyond tree planting.

In recent months, research from amongst others The Guardian has claimed that various REDD+ credits do not represent genuine carbon emission reductions. The consensus about the recent scrutiny REDD+ projects have caught within the carbon market consists of two elements:

- Highlighting the importance of protecting and conserving forests is essential. Yes, carbon credits are imperfect – but we need them. The truth is nuanced. To stand a chance of preventing catastrophic global warming, Credits must be one of several tools in our arsenal.If you are interested in obtaining carbon credits, check out our carbon credit page.

- Constructive feedback and critique are essential to improve existing methodologies, foster innovation and maximize impact. This applies to REDD+ projects but also to other climate solutions, be it nature-based on technological.

Core Carbon Principles by the IVCCM

To raise the bar for carbon credits and foster a greater sense of transparency within the voluntary carbon market, the ICVCM has taken a significant step forward by introducing the Core Carbon Principles (CCPs) and the Program-level Assessment Framework. These initiatives aim to set rigorous criteria for high-integrity carbon credits and promote sustainability. Developed with valuable input from numerous organizations within the voluntary carbon market, the CCPs establish fundamental principles based on the latest science and best practices, ensuring that carbon credits create genuine and verifiable climate impact.

With a core objective of establishing trust and driving investment towards effective climate solutions, the CCPs create a universally recognizable standard for high-integrity carbon credits, regardless of their origin, type, or issuing program. In doing so, the CCPs eliminate confusion and bridge market fragmentation, instilling confidence in buyers that their investments support projects making a genuine and significant impact on reducing emissions. By providing this consistent benchmark, the CCPs open doors to increase investment opportunities, accelerating the funding of essential climate initiatives on a large scale and with rapid speed.

To attain the CCP label, carbon credits must undergo a thorough assessment and meet the rigorous criteria for high climate, environmental, and social integrity set forth by the Integrity Council. Both the carbon-crediting program responsible for issuing the credits and the specific credit category must meet these stringent standards, as outlined in the CCPs and Assessment Framework. Only upon successful assessment of both aspects will the carbon credits receive the distinguished CCP label, signifying their elevated level of integrity and credibility in advancing climate solutions.

The CCPs outline additional criteria for carbon credits to be considered high-integrity. Apart from the requirements on transparency and sustainable development, the CCPs specify that carbon credits must fulfill the following conditions:

- Additional: the emission reductions and removals funded by the credits should be generated by projects that would not have taken place without the financing from carbon credits.

- Permanent: the impact of the emissions reductions and removals must be lasting and not subject to reversal in the future.

- Measured robustly and conservatively: the quantification of emissions reductions and removals must be accurately and conservatively measured to ensure credibility and avoid overestimations.

- Counted only once: the carbon credits should not be double counted, ensuring that the claimed emission reductions are only attributed to a single entity.

- Supporting transition to Net Zero: the funded projects must contribute to the overall transition to a net-zero emissions future. The projects should not perpetuate or support activities that are incompatible with achieving a net-zero emissions goal.support activities that are incompatible with achieving a net-zero emissions goal. If you're unsure about what Net Zero means and how it differs from carbon neutrality, check out our blog here.

Regarding the carbon-crediting programs, they must adhere to the following criteria:

- High standards of governance: the programs must maintain strong governance practices to ensure the overall quality and integrity of the issued carbon credits.

- Use of registry: a registry should be utilized to uniquely identify and track each carbon credit from issuance to retirement or cancellation, enhancing transparency and accountability.

- Independent verification: the emission reductions and removals claimed by the programs must be verified by independent third-party experts to confirm their accuracy and reliability.

| Partnership between ICVCM and VCMI |

|---|

| The collaboration between the ICVCM and the VCMI is paving the way for an integrated market integrity framework. This framework will empower companies to contribute significantly to the global effort of limiting temperature rise to 1.5°C. The focus will be on critical elements, including: 1. Decarbonizing the value chain: companies will be urged to prioritize decarbonization throughout their value chain by investing in clean energy, sustainable transport, and environmentally friendly industrial processes. Alongside preserving natural ecosystems. 2. Emphasizing the complementary role of high-integrity credits: the role of high-integrity carbon credits in a credible corporate climate strategy will be clarified through clear guidelines. The Core Carbon Principles (CCPs) and VCMI Claims Code of Practice will set global standards, ensuring that these credits create real and verifiable climate impact based on the latest scientific insights and best practices. 3. Aligning with Paris Agreement: encouraging companies to commit to quantified and independently verified science-based emissions reduction targets in line with the UNFCCC Paris Agreement and the 1.5-degree pathway. This involves enhancing reporting requirements, disclosure mechanisms, and providing clear guidelines on the usage of high-quality carbon credits as they work towards achieving net-zero emissions. |

Evidence shows that investing in high-quality carbon credits, when complemented with science-based internal decarbonization efforts, can effectively accelerate progress towards the 1.5°C temperature goal. These credits also unlock vital financial resources for urgently needed climate solutions that may not be feasible otherwise. By integrating these principles and practices, companies can make a significant and positive impact on combatting climate change and driving the world closer to its temperature limitation targets.

Trove Research: the value of carbon credits

As mentioned earlier, a recent analysis of Trove has highlighted the importance of carbon credits. According to its recent report, companies that are material users of carbon credits decarbonize twice as fast as those that do not use carbon credits.

The analysis examined emissions data from 4,156 companies over the past five years using the Trove Intelligence platform. It revealed a significant trend where companies using a 'material' amount of carbon credits showed faster emission reductions compared to those that did not use such credits. This trend held across all time periods, nearly all sectors and regions, and all scopes of emissions, even when considering different thresholds for 'material' credit usage.

Moreover, 'heavier' users of credits were found, on average, to decarbonize more rapidly than 'lighter' users, and those using higher integrity or higher-priced credits also demonstrated quicker emission reductions, although this correlation was somewhat weaker in comparison to other patterns.

The findings debunk the notion that companies buying carbon credits are simply obtaining a 'license to pollute.' Instead, they suggest that the voluntary purchase of carbon credits provides companies with an incentive to accelerate their emission reduction efforts. By attaching a price to their emissions through credit purchases, companies create an annual cash expenditure that motivates them to reduce costs and strengthen the business case for emission reduction initiatives in their budget approval processes.

Firms engaging with carbon credits are also likely to be committed to addressing their climate impact seriously and have well-developed mitigation and carbon credit strategies.

Ultimately, the analysis indicates that while it's essential to improve credit quality over time, carbon credits can effectively aid companies in mitigating their emissions impact and encouraging a reduction in their overall carbon footprint.

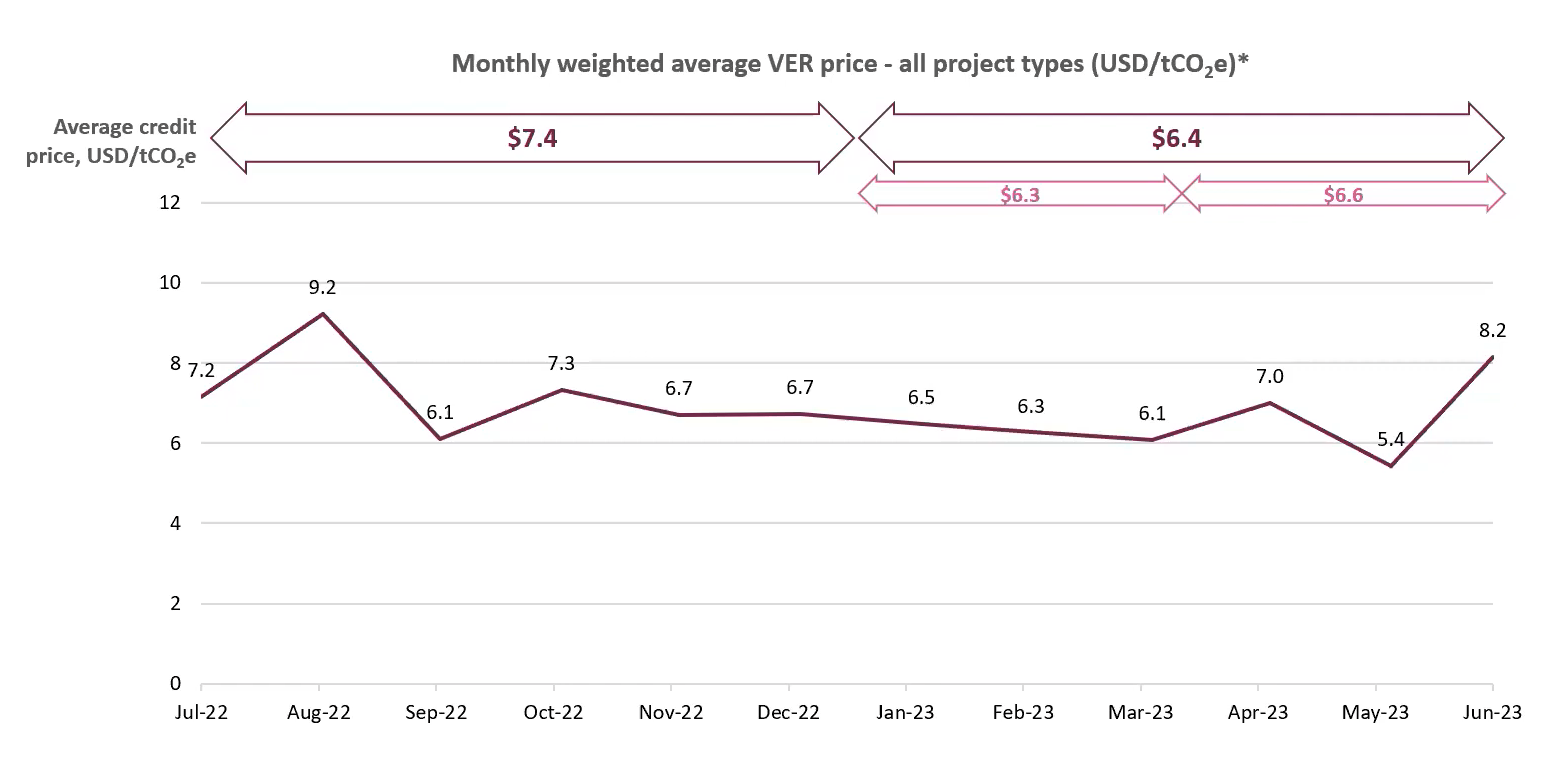

Carbon price developments

Over the last five years, the VCM has shown remarkable expansion. In 2022, the VCM is projected to have attracted approximately USD 1.3 billion in investments, contributing to the mitigation of around 161 million metric tons of greenhouse gas emissions. The significance of rising prices of carbon credits is twofold:

- Incentivizing emission reduction: higher carbon credit prices result in increased penalties that companies must pay for their emissions. This creates a stronger incentive for companies to expedite the reduction of their own carbon emissions. When the cost of emitting carbon rises, it becomes financially advantageous for companies to invest in cleaner and more sustainable practices, technologies, and processes. This, in turn, contributes to accelerated efforts in combatting climate change.

- Driving climate action financing: rising carbon credit prices attract more financing towards climate action projects. As prices increase, the potential return on investment becomes more appealing to investors and companies alike. Consequently, more capital flows into a greater number of climate action initiatives. These projects can then become more ambitious and innovative, as higher revenues from carbon credits allow for larger-scale and more groundbreaking endeavors. This positive feedback loop further encourages the development of effective solutions to address climate challenges on a broader scale.

Despite this impressive progress, the growth momentum of the VCM encountered a slowdown in 2022, likely due to the impact of the invasion of Ukraine, in contrast to the positive trajectory established in 2021. However, the average prices of various technology types in the carbon market remained notably higher than the five-year average.

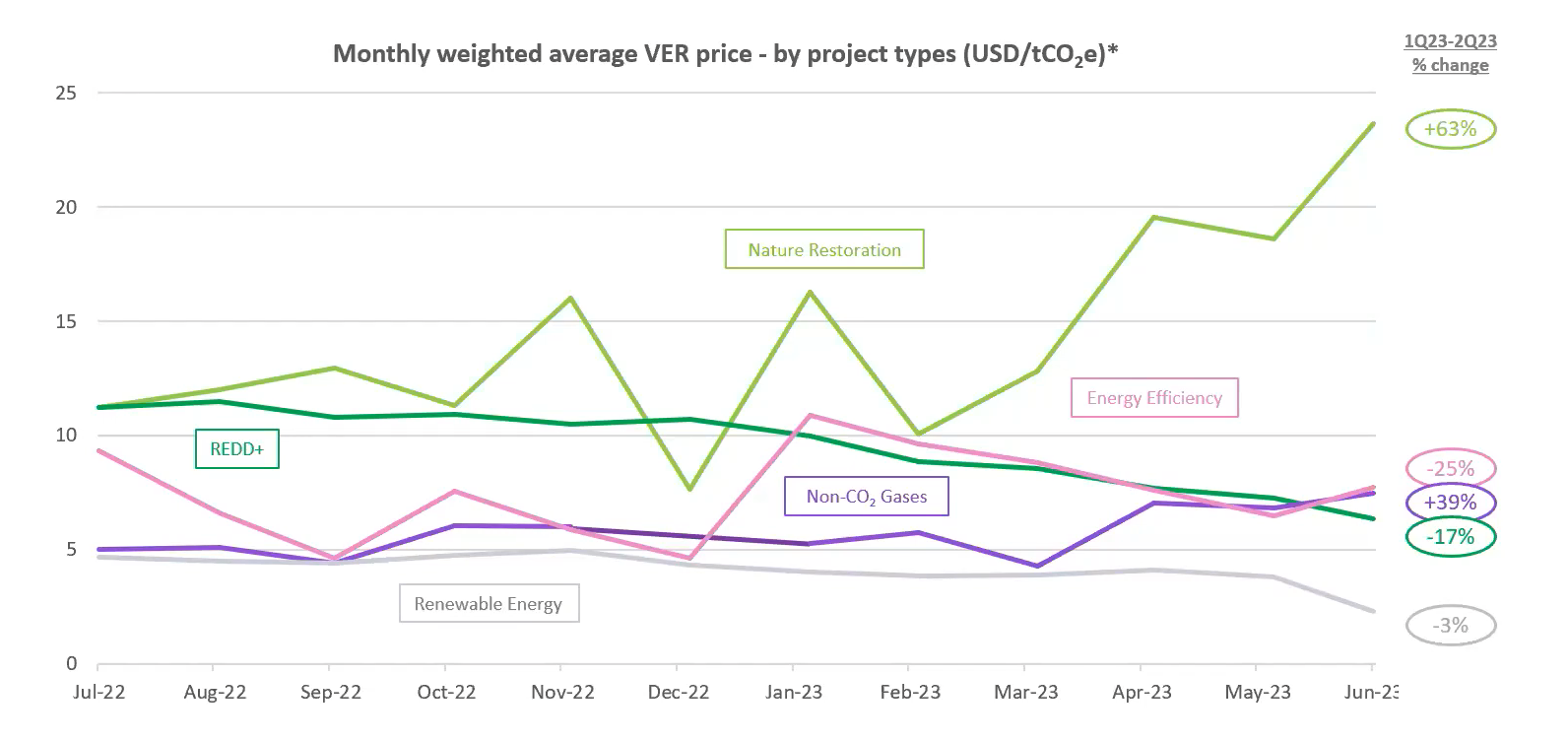

Since the invasion of Ukraine, prices have been readjusting downward as the market seeks to find a new balance. The scrutiny around REDD+ has also contributed to a recalibration of carbon prices in general. In June, a slight market recovery is noticeable although it is too early to tell whether this will continue in the coming months.

Interestingly, community-based projects, like efficient cookstoves, have emerged as a relatively stable and resilient category alongside Nature-Based Solutions (NBS) removal credits. This observation, coupled with supply and demand patterns, indicates a growing preference for projects that offer substantial co-benefits beyond simply reducing carbon emissions. Investors and market participants seem increasingly interested in supporting projects that have positive social and environmental impacts in addition to their carbon reduction potential.

Do you want to discuss these developments?

If you want to get in touch to discuss these developments, click here or schedule a meeting. To stay up to date, sign up for our newsletter below.

Check out our recently published positive climate news for some motivational news to brighten your day!