In this update, we discuss the latest developments in the voluntary carbon market (VCM). This includes market trends, regulatory changes, best practices and carbon pricing developments. Keep an eye on our website to stay up to date with the latest developments in the carbon market.

Short roundup: market trends & key developments

2023 was a tumultuous year for the voluntary carbon market. As described in the previous update, last year saw strong criticism of REDD+ conservation projects, among others. These projects would more often than not fail to deliver on their promise of achieved impact. Each carbon credit is supposed to represent an equivalent of one ton of carbon reduced, avoided or removed. Organizations can purchase these credits to offset their emissions. When it became apparent that a number of projects were not achieving this impact, demand for credits decreased and credit prices dropped.

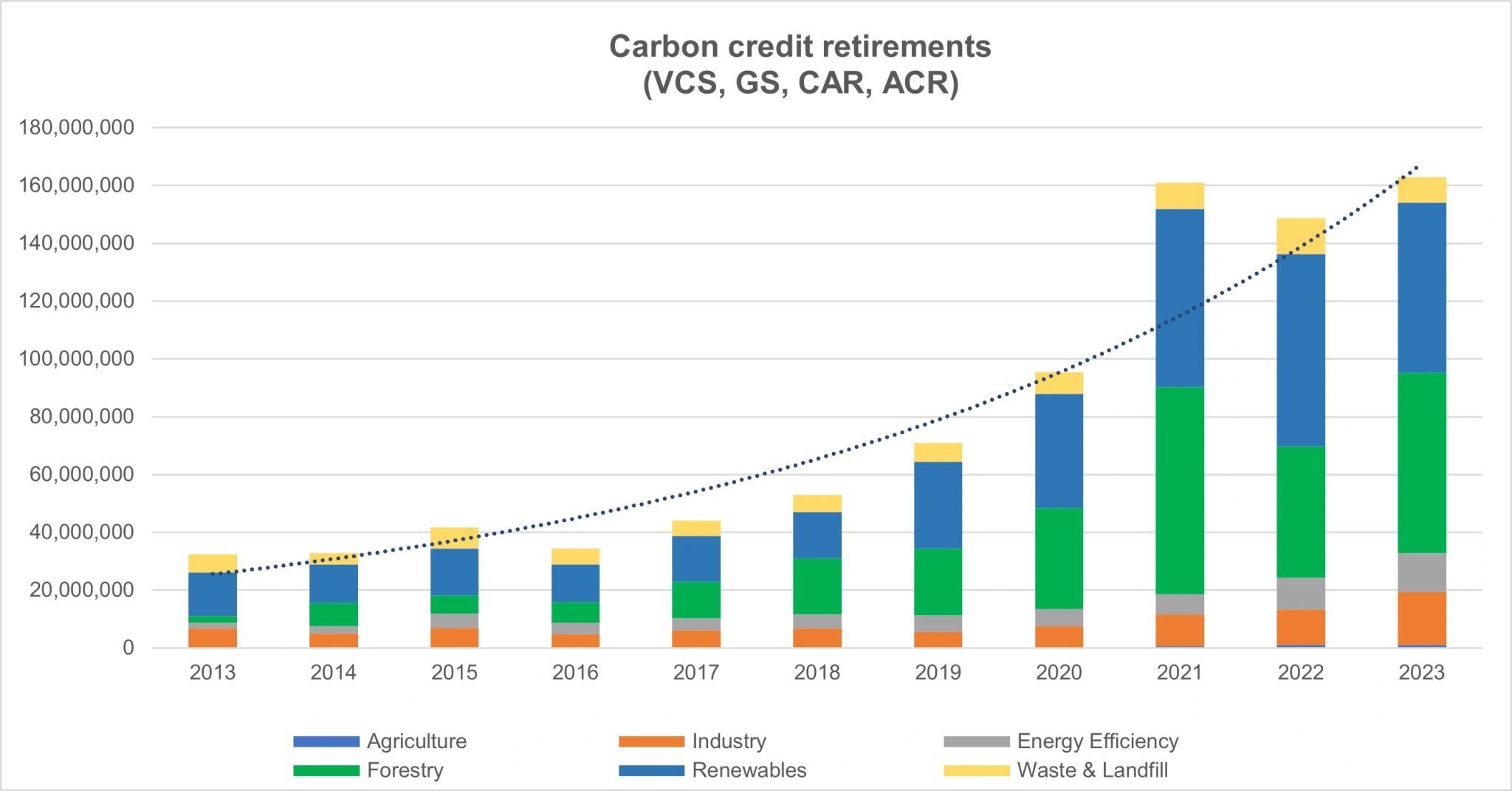

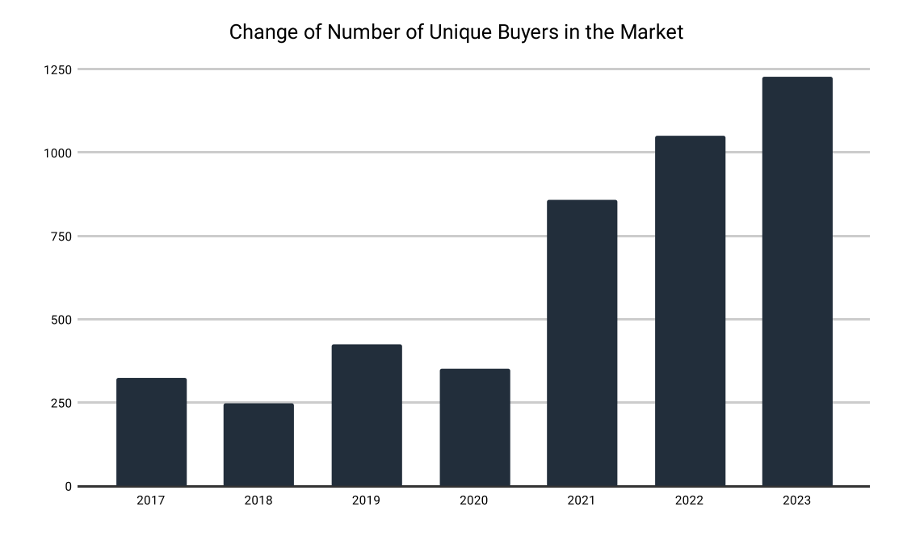

The question, then, was whether the market turmoil was temporary and whether the market would recover. Meanwhile, there are enough signs to answer these questions in the affirmative. For example, more credits were retired in December than ever before, breaking the previous (December) record by more than 40%. In addition, this year almost 10% more credits were retired than in 2022. In total, more than 372 million credits were issued in 2023 and more than 160 million credits were retired to offset carbon emissions.

Source: Allied Offsets 2023

Source: Allied Offsets 2023

Carbon markets were also the focus of much attention during COP 28 in Dubai. The COP Presidency hosted a roundtable on progress on VCMs with higher integrity and quality. In it, John Kerry, Special Climate Envoy to the President of the United States, praised the VCM tool and recent developments, "I have become a firm believer in the power of carbonmarkets to drive greater climate ambition and action, and the VCM is an essential tool to keep 1.5C within reach." The importance of inclusive access to VCMs for developing countries was further emphasized by UN Climate Change Secretary Simon Stiell and World Bank President Ajay Banga.

In addition, at COP 28, the six major voluntary standards announced a historic collaboration. The collaboration - between Gold Standard, Verra, the American Carbon Registry, Architecture for REDD+ Transactions (ART), Climate Action Reserve, and Global Carbon Council - aims to "promote integrity in 2024 to take the next step in the reliability of carbon markets."

All in all, it can be said that 2023 posed significant challenges to carbon markets. However, it seems that these challenges have given a positive impetus to the market and made it more mature - or at least awake. There is agreement that the VCM, although imperfect in practice at present, remains a crucial tool for meeting the target of the Paris Climate Agreement.

VCM recap 2023: ups and downs

In 2023, the carbon market faced significant challenges and the effectiveness of carbon markets was questioned by some. However, a closer look reveals that the situation is more nuanced and the market has been able to recover, challenging all stakeholders - project developers, buyers and sellers - to further ensure the quality, integrity and transparency of carbon credits.

Starting with the challenges in 2023. The year began with persistent negative media coverage that focused on a specific project type: REDD+ projects. REDD+ projects focus on the conservation and restoration of forests that act as vital carbon repositories, absorbing and storing significant amounts of carbon. Forests play a crucial role in mitigating climate change by taking carbon from the air and storing it in their biomass and soil. REDD+ initiatives address deforestation and degradation, preserve valuable ecosystems and reduce carbon emissions, while providing financial incentives for forest conservation. These financial incentive benefit local communities and indigenous people.

Research by The Guardian and others revealed that several REDD+ credits did not represent real carbon emission reductions. This affected confidence and drew attention to market integrity initiatives and the publication of long-awaited updates to certification methodologies. The damaged confidence resulted in a drop in prices as demand for credits declined for several months. While some might consider this a "stagnation" of the market, it is also seen as a necessary "regrouping" before an expected "acceleration forward."

Indeed, there were also positive developments in 2023: despite the (justified) negative news coverage, carbon credit retirements did not fall as expected and the total was higher than in 2022. This indicates continued corporate commitment. Research by Allied Offsets found that over 1,200 additional companies chose to offset emissions in 2023 compared to 2022, indicating growing acceptance of the "polluting is paying" standard.

Source: Allied Offsets 2023

Source: Allied Offsets 2023

Cooperation between certification standards

At COP 28, the six major voluntary standards announced a major collaboration. The collaboration - between Gold Standard, Verra, the American Carbon Registry, ART (Architecture for REDD+ Transactions), Climate Action Reserve, and Global Carbon Council - aims to "promote integrity by 2024 to take the next step in the reliability of carbon markets”.

These organizations signed a document to: (1) act together to learn from each other in order to strengthen programs; (2) pursue alignment on common principles for quantification and accounting; (3) jointly pursue permanence and related measures; (4) ensure robust benefit sharing; (5) identify and encourage disclosures around deployment of carbon credits; and (6) enable financial flows to developing countries.

In addition to certification standards taking an additional step in ensuring quality, a significant development is the creation of an end-to-end integrity framework by SBTi (Science-Based Targets Initiative), the VCMI and ICVCM. These organizations agreed to establish harmonized guidelines for corporate decarbonization, including the role of carbon credits in corporate transition to Net Zero. This end-to-end framework was supported by a joint statement signed by 17 international NGOs. The statement highlights the role of transparent carbon credits as part of a broader corporate transition, in line with scientific understanding.

The fact that SBTi sees a more active role for credits is significant. SBTi is a leading framework for setting net-zero targets for companies in line with climate science and includes thousands of companies that have publicly committed to science-based net-zero targets.

In 2023, SBTi launched an open consultation on its Beyond Value Chain Mitigation Guidance Paper. Beyond value chain mitigation refers to mitigation actions or investments made outside a company's value chain, for example, the purchase of carbon credits. The purpose of the consultation is to provide companies with benchmarks and best practices where mitigation efforts 'outside the value chain' are concerned. By providing clear guidelines, it will make it easier for companies to support carbon projects as part of their strategy in a way that is credible and transparent. Trust in the VCM will increase as a result. This creates a foundation for hundreds of new potential participants in the VCM.

Source & Copyright: COP28

Source & Copyright: COP28

Emphasis on quality

The past year has seen - against the backdrop of negative publicity - an emergence of independent quality assurance initiatives. These include the Core Carbon Principles of the Integrity Council of the Voluntary Carbon Market and the Carbon Credit Quality Initiative announced.

These organizations have established a set of quality characteristics for carbon credit projects. The various quality characteristics are as follows:

- Additionality: the emission reductions or removals would not have occurred without the added incentive of carbon credits.

- Measurement, Reporting and Verification: the project or program uses robust principles, provisions and methodologies to quantify emission reductions and removals.

- Permanence: the credit carries no risk of losing the underlying climate benefit (e.g., from stored carbon - released due to natural or man-made impacts), or it has adequate provisions to mitigate those risks.

- Leakage: the project or program considers the extent to which reductions or removals from a mitigation activity are offset by increased emissions elsewhere.

- Transparency: the project or program facilitates access to relevant non-confidential information, including ensuring that sufficiently detailed information on all projects is publicly available and that program requirements and decision-making are transparent.

- Ancillary benefits: the project or program promotes significant positive socioeconomic benefits for the UN Sustainable Development Goals beyond greenhouse gas emission reductions.

- Social and Environmental Protection: the project or program establishes safeguards to ensure that there is no worse than a "no harm" approach to social and development impact, especially by enabling global, regional and local stakeholders affected by the effort to voice concerns, demand fair treatment and, where appropriate, pursue legal redress or compensation.

- Revenue sharing: the project or program establishes a mechanism for fair distribution of revenues and other benefits in consultation with local stakeholders.

There are also developments on the side of companies buying credits to clarify how companies can best claim credits for their climate action strategies. A good example of this is the Claims Code of Practice of the Voluntary Carbon Markets Integrity Initiative.

New research: companies that offset reduce faster

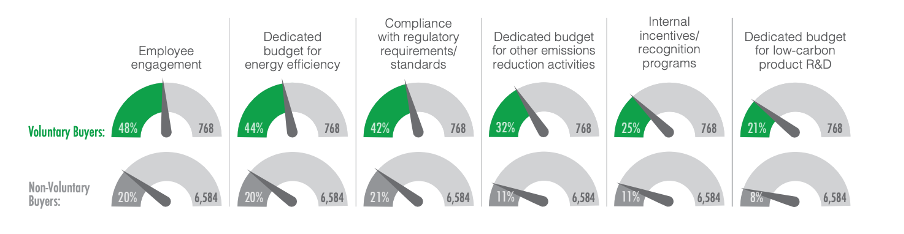

In our previous update, we wrote that on average, companies that offset carbon reduce twice as fast compared to those that don't. New research recently published again suggests that companies that offset are leading the way when it comes to climate action. Across the board, they outperform companies that do not buy carbon credits. The research relies on transactions in voluntary carbon markets and climate pledges from 7,415 companies.

Companies participating in voluntary carbon markets show significant acceleration in reducing their own emissions compared to their competitors. These companies show a 1.8 times greater likelihood of annual carbon reductions. In addition, they are found to be 1.3 times more likely to actively involve suppliers in their climate strategy. Purchasing carbon credits thus involves active collaboration between companies, suppliers, employees and customers to address climate change impacts. In addition, the average buyer of voluntary credits invests three times more in emission reduction efforts within their value chain. These investments include activities such as the use of renewable energy and the purchase of Renewable Energy Certificates (RECs).

Source: Ecosystem Marketplaces 2023

Source: Ecosystem Marketplaces 2023

Buyers of voluntary carbon credits show a greater propensity to set goals to address climate change, with their goals being significantly more ambitious. They show a 3.4 times greater likelihood of having science-based climate goals, a 1.2 times greater likelihood of having managerial oversight of their climate transition plans, and a three times greater likelihood of including Scope 3 emissions in their climate target. This is notable because Scope 3 emissions make up the lion's share (91%) of carbon buyers' emissions and are the most difficult for companies to control, as these emissions are generated by upstream suppliers, downstream customers and other companies in the value chain.

Interested in learning more about the role of carbon offsetting in a sustainability strategy? Follow this link.

Price developments in the voluntary carbon market

As described above, the controversy surrounding some projects has had a negative impact on rising prices in recent years. Indeed, in principle, rising prices are a good thing since it means a greater cost for companies, which in turn gives a greater incentive to reduce emissions. The hope (and long-term expectation) that prices in the voluntary carbon market will move closer to the "true price" of a ton of emissions in the future, or close to the European Trading System, remains intact but is still some years away.

REDD+ projects in particular have shown flattening and in some cases decline in price. By extension, stagnation was seen for other projects, such as Nature-based Solutions and renewable energy projects. Toward the end of the year, a slight increase in prices was noticeable, with hopes within the market that this is one of the signs of further recovery.

Looking ahead, there is hope and expectation in the market that the recovery will continue. For this, it is particularly important that all integrity and quality initiatives get off the ground, that awareness around the role of offsets increases, and that business and governments act together in the development of future-proof (compliance and voluntary) CO2 markets.

Would you like to discuss these developments?

If you would like to get in touch to discuss these developments, click here or schedule an appointment. To stay informed, please sign up for our newsletter below.